- HOME

- Overview

- Sustainability

- Initiatives for Climate Change

Initiatives for Climate Change

FRC’s Recognition of Climate Change

In the Asset Management Company, we acknowledge the scientifically proven progression of climate change, as outlined in the Paris Agreement (2015), the IPCC Special Report (2018), and the IPCC Sixth Assessment Report (Working Group I, 2021). We recognize climate change as a significant (material) challenge that brings about dramatic changes to the natural environment and social structures, exerting a profound impact on the management and overall business of FRC. Based on this recognition, the Asset Management Company established the Policy on Climate Change and Resilience in August 2022. This policy outlines our approach to responding to risks and opportunities associated with climate change, as well as initiatives to ensure the resilience (strength and buoyancy) of operations and strategies relative to climate-related issues.

TCFD Endorsement (and Participation in the TCFD Consortium)

The Asset Management Company expressed its support for the Task Force on Climate-related Financial Disclosures (TCFD) in September 2022 to promote disclosure of information related to climate-related issues. Alongside this endorsement, we are also a member of the TCFD Consortium. Within this consortium, which includes numerous companies and organizations endorsing TCFD in Japan, discussions take place on how information on climate-related issues should be disclosed and used.

Governance

System for Promoting Sustainability

The Asset Management Company has established a Sustainability Policy and related internal regulations as specific practical guidelines to consistently and systematically promote sustainability initiatives, as well as the Sustainability Promotion Committee. This Committee meets at least twice a year in principle to examine goals and measures related to climate change issues and determine the progress of initiatives. It comprises President and CEO, Executive Officers, and the general managers of each division. President and CEO makes final decisions regarding sustainability, while the general manager of the Planning Department holds the role of Sustainability Officer.

In addition, to streamline the execution of sustainability initiatives, we have established the Sustainability Promotion Office. Comprising sustainability representatives from diverse departments, this office operates in accordance with decisions made by the ultimate authority on sustainability. This structure enables the effective implementation of activities associated with sustainability promotion.

The Asset Management Company positions climate-related issues as one of its sustainability challenges and has established the following governance structure to address climate-related risks and opportunities associated with FRC.

President and CEO holds the highest authority for climate-related issues, serving as the ultimate decision-maker for sustainability. The executive overseeing climate-related matters is the general manager of the Planning Department, responsible for the supervision of sustainability promotion.

This executive consistently reports to President and CEO within the Sustainability Promotion Committee, covering various aspects such as identifying and assessing the impacts of climate change, managing risks and opportunities, providing updates on initiatives related to adaptation and mitigation, and reporting on climate change responses, including the establishment of indicators and goals. The Sustainability Promotion Committee deliberates on each agenda item with the participants, and final decisions rest with President and CEO.

Role of Management

President and CEO serves as the chairperson of the Sustainability Promotion Committee and, as the ultimate decision-maker for sustainability (also the highest authority for climate-related issues), makes final decisions regarding the implementation of related measures.

President and CEO also periodically reports on specific targets, proposals, and progress on sustainability initiatives determined by the Sustainability Promotion Committee to the Board of Directors of both the Investment Corporation and FRC.

Oversight by the Board of Directors

President and CEO serves as the chair of the Board of Directors for the Asset Management Company.

The Board of Directors is responsible for making the final decision on the formulation and revision of the Sustainability Policy, which represents the specific operational guidelines for sustainability for the Asset Management Company.

Furthermore, the Board of Directors monitors and supervises the sustainability initiatives of the Asset Management Company by receiving reports from the Sustainability Promotion Committee and offering guidance as necessary.

Strategy

The Asset Management Company has established a process to identify, assess, and manage the impacts of climate-related risks and opportunities on its business activities, strategies, and financial plans. Ongoing analyses are being conducted.

The Asset Management Company, in conjunction with its commitment to the TCFD in September 2022, released the results of its first scenario analysis. It subsequently conducted a second scenario analysis, reassessing risks and opportunities.

Scope of Analysis

In the most recent scenario analysis, the focus is on FRC’s real estate leasing business.

The analysis timeline is set for 2030 (medium term) and 2050 (long term).

External Scenario Referenced

In accordance with the TCFD recommendations, it is advisable to articulate the resilience of one’s own strategy, taking into account multiple scenarios, including those aligning with the goal of limiting global warming to below 2°C. The scenarios referenced by the Asset Management Company in conducting the scenario analysis follow.

This table can be scrolled sideways.

| Risk type | Source | 1.5℃ Scenario | 4.0℃ Scenario |

|---|---|---|---|

| Transition risk | International Energy Agency (IEA) World Energy Outlook 2020 |

IEA NZE2050 | IEA STEPS |

| Physical risk | Intergovernmental Panel on Climate Change (IPCC) Fifth Assessment Report |

IPCC RCP2.6 | IPCC RCP8.5 |

Envisioned Worldview in Each Scenario

Based on each scenario, the Asset Management Company envisions the following worldview.

■1.5℃ Scenario

The 1.5°C Scenario is premised on the introduction of stringent regulations, tax measures, and other initiatives to combat climate change, aiming to achieve a decarbonized society.

As part of a worldwide effort to address climate change, there is an anticipated shift toward decarbonization within the socioeconomic landscape. This entails establishing frameworks for reducing greenhouse gas emissions and enhancing emission regulations.

This shift has the potential to significantly impact the operations of both the Asset Management Company and FRC.

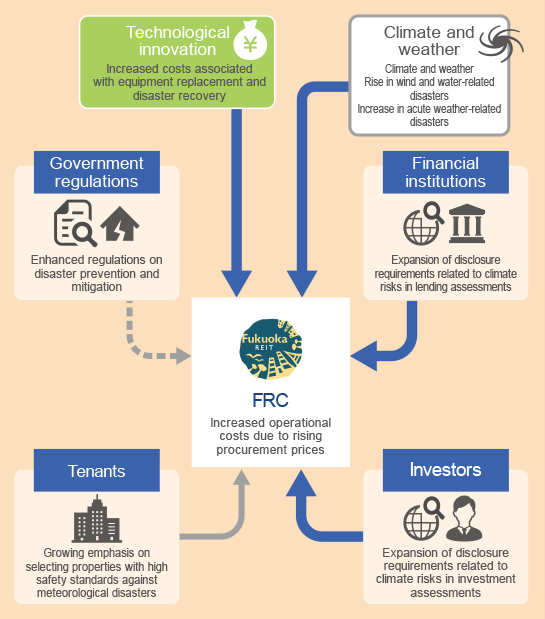

■4.0℃ Scenario

The 4.0°C Scenario is based on the premise that stringent regulations and tax measures necessary to achieve a decarbonized society are not implemented, resulting in a continued increase in greenhouse gas (GHG) emissions.

As climate change advances, we anticipate an increase in the frequency and intensification of meteorological and climate-related disasters, including severe typhoons, heavy rainfall, more frequent heatwaves and droughts, and the ongoing rise in global sea levels.

This has the potential to significantly impact the operations of both the Asset Management Company and FRC.

(Image of worldview)

- <1.5℃ Scenario>

- <4.0℃ Scenario>

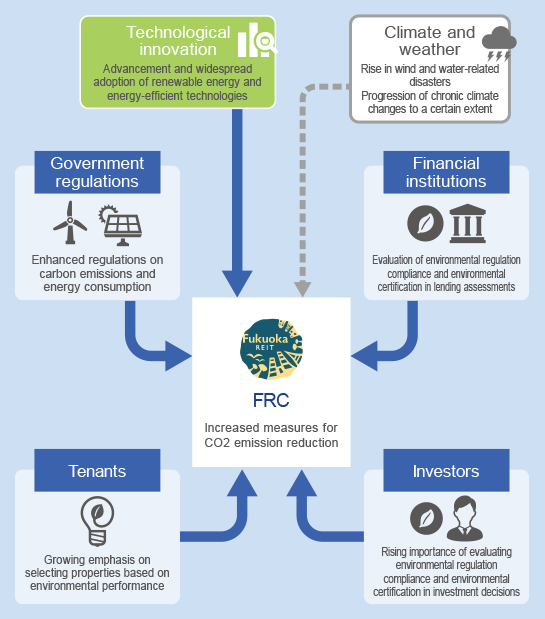

Identification of Risks and Opportunities

The Asset Management Company has identified risks and opportunities based on scenarios and assessed their impact on business as outlined below. For the financial impact, we conducted both qualitative and quantitative assessments, referring to the aforementioned scenarios and literature provided by industry associations.

Qualitative Analysis Results of Climate-Related Risks and Their Financial Impact

■Risks and Opportunities

This table can be scrolled sideways.

| Risk and opportunity factors and financial impacts | Importance | Response to risks and opportunities | |||

|---|---|---|---|---|---|

| 2030 | 2050 | ||||

| Transition risk | Policy and legal | The introduction of carbon pricing results in an increased carbon tax burden. | Low | Medium |

|

| Technology | Expenses increase for energy-saving and energy-creating measures for existing properties, including energy conservation, energy storage, ZEB/ZEH conversion, and solar power generation. | High | High |

|

|

| Market | Market preferences lead to an increase in vacancy rates and a decline in rents for properties not aligned with decarbonization. | Low | Low |

|

|

| Reputation | Delayed adoption of decarbonization measures results in a decline in investment unit prices and missed opportunities for external growth. | - | - | ||

| Delayed implementation of decarbonization measures leads to an increase in loan interest rates and a shortening of borrowing periods. | Low | Low | |||

| Physical risk | Acute | Increased frequency of disasters results in a rise in damage costs and disaster recovery expenses. | High | High |

|

| Increased frequency of disasters leads to a rise in disaster preparedness expenses. | Low | Medium | |||

| Chronic | The rise in air-conditioning usage due to increasing temperatures results in higher utility costs. | Low | Low |

|

|

| Expenses for addressing the impacts of rising sea levels increase. | Low | Low | |||

| Opportunities | Resource efficiency | Implementation of energy-saving measures leads to a reduction in energy procurement costs. | Low | Low |

|

| Energy sources | As the transition to clean energy progresses, the carbon tax burden decreases. | Low | Low | ||

| Products and services | The increased supply of ZEB properties in the market leads to an increased opportunity for acquiring such properties. | - | - | ||

| Market | Market preferences lead to an increase in vacancy rates and a decline in rents for properties not aligned with decarbonization. | Low | Medium |

|

|

| The success of decarbonization measures leads to an expansion of lending partners and opportunities. | Low | Low |

|

||

| The success of decarbonization measures opens up new investor segments. | - | - |

|

||

| Resilience | The success of disaster preparedness measures results in a reduction in damage costs and disaster recovery expenses. | Medium | Medium |

|

|

- Items for which evaluation or calculation is difficult are indicated with “-”.

Quantitative Analysis Results of Climate-Related Risks and Their Financial Impact

■Financial Impact

(Millions of yen)

This table can be scrolled sideways.

| Scenario | Details of financial impact | 4.0℃ | 1.5℃ | Additional information | |

|---|---|---|---|---|---|

| Transition risks and opportunities | Carbon tax burden increases. | Risk | - | -352 |

|

| Countermeasure effects | - | 188 |

|

||

| Increased costs for energyefficient retrofitting and energygenerating on-site renovations for existing properties. | Risk | - | -783 |

|

|

| Opportunity | Reflected in the effects of carbon tax countermeasures, energy procurement costs, and opportunities in the real estate leasing business | ||||

| Energy procurement costs decrease with renovations. | Countermeasure effects and opportunity | - | 119 |

|

|

| Vacancy rates increase and rents decline for properties not aligned with decarbonization. | Risk | - | -91 |

|

|

| Opportunity | - | 329 |

|

||

| Physical risks and opportunities | Damage costs and disaster recovery expenses increase due to water damage. | Risk | -169 | -56 |

|

| Countermeasure effects | 38 | 13 |

|

||

| Expenses for water damage prevention measures increase. | Risk | -103 | -65 |

|

|

| Utility costs increase due to the rise in air-conditioning usage. | Risk | -14 | -3 |

|

|

| Countermeasure effects | - | 2 |

|

||

| Expenses for addressing the impacts of rising sea levels increase. | Risk | - | - |

|

|

- Items not yet calculated are represented as “-”.

- This simulation reflects only the aspects deemed calculable at present and does not assess all climate-related risks associated with FRC. Moving forward, we will strive to evolve our analysis in response to developments in global and Japanese climate-related risks.

- The simulation was conducted by considering FRC’s existing financial information, taking into account information provided by climate-related scenarios and literature. The unit is primarily in the form of impact amounts (millions of yen) per year on a cash basis, and the time frame assumes the year 2050. Note that the accuracy of the calculations cannot be guaranteed at present. In addition, the assumed countermeasures are based on simulation and are not decisions or plans that have been executed.

Concrete Initiatives in Response to Risks and Opportunities

We aim to achieve the current CO2 reduction targets associated with transition risk. We will pursue energy-efficient upgrades, including LED conversions, and enhance energy efficiency during facility updates.In addition, we will explore initiatives such as the integration of solar power generation and consider transitioning ZEB and ZEH.

Furthermore, we will look into the greening of externally sourced energy.

We are currently mitigating physical risk through insurance coverage. We will also conduct ongoing risk monitoring, including the review of hazard maps, and implement necessary measures as required. By conducting BCP exercises and addressing various operational aspects, our goal is to effectively mitigate risks.

Risk Management

The process by which the Asset Management Company manages climate change–related risks is as follows.

●Process of Identifying and Evaluating Risk

The risks and opportunities related to climate change are addressed through a climate-related working group. This group, led by the executive responsible for climate-related issues, convenes representatives from various departments believed to be necessary for the identification and assessment of climate-related risks. The process involves listing and identifying risk items, qualitatively assessing business impacts, and evaluating risk significance. The outcomes are then deliberated and assessed, and subsequently presented to the Sustainability Promotion Committee for consideration.

The Sustainability Promotion Committee deliberates on climaterelated risks identified by the working group that need to be prioritized based on the likelihood of occurrence and impact and draws up risk management responses in order of priority. The Committee also deliberates on climate-related opportunities and establishes prioritization for business strategy.

Furthermore, the Committee reports on the deliberation and review process to the Board of Directors.

●Process of Managing Risks

The executive with ultimate responsibility for climate-related issues designates responsible departments or individuals and instructs the formulation of countermeasures for climate-related risks and opportunities of high priority in business and financial planning, as deliberated in the Sustainability Promotion Committee.

The countermeasure plans formulated by the designated departments or individuals are reviewed and approved in internal forums such as the Sustainability Promotion Committee, depending on their content, before being implemented.

Regular progress reports on the implemented measures are submitted to the Committee, where the advancement of responses to risks and opportunities is monitored and verified.

●Integration into Comprehensive Risk Management

In the Asset Management Company, based on the Risk Management Regulations, each department head is designated as a risk management officer. A Risk Management Committee has been established to monitor the risk management status overseen by these officers. The Committee convenes at least once every three months in principle, focusing on identifying, understanding, and managing various potential risks.

The executive with ultimate responsibility for climate-related issues instructs the inclusion of significant climate-related risks in business and financial planning within the existing company-wide risk management program through the executive in charge of climate-related issues. This directive aims to integrate the process of identifying, assessing, and managing risks within the Risk Management Committee.

Metrics and Targets

The Asset Management Company has established key performance indicators (KPIs) and goals to manage and monitor risks and opportunities. These metrics, targets, and results are outlined below.

●Reduction of Environmental Load

- 35% reduction in CO2 emissions by 2030 (compared with 2019, basic unit)

●Maintenance and Enhancement of Environmental and Construction Performance

- 85% Green Building Certification rate or higher by 2030